Universal Life Insurance: Secure Your Legacy USA

Universal life insurance is a form of permanent life insurance with flexible premium payments and a cash savings component. Policyholders can borrow against or cash in the savings portion, which grows tax-deferred.

Universal life insurance is a form of permanent life insurance with flexible premium payments and a cash savings component. Policyholders can borrow against or cash in the savings portion, which grows tax-deferred.

Universal life insurance provides a flexible approach to permanent life insurance, offering policyholders the ability to adjust premium payment amounts and access a cash savings component. This type of insurance provides a death benefit along with the potential for cash value accumulation.

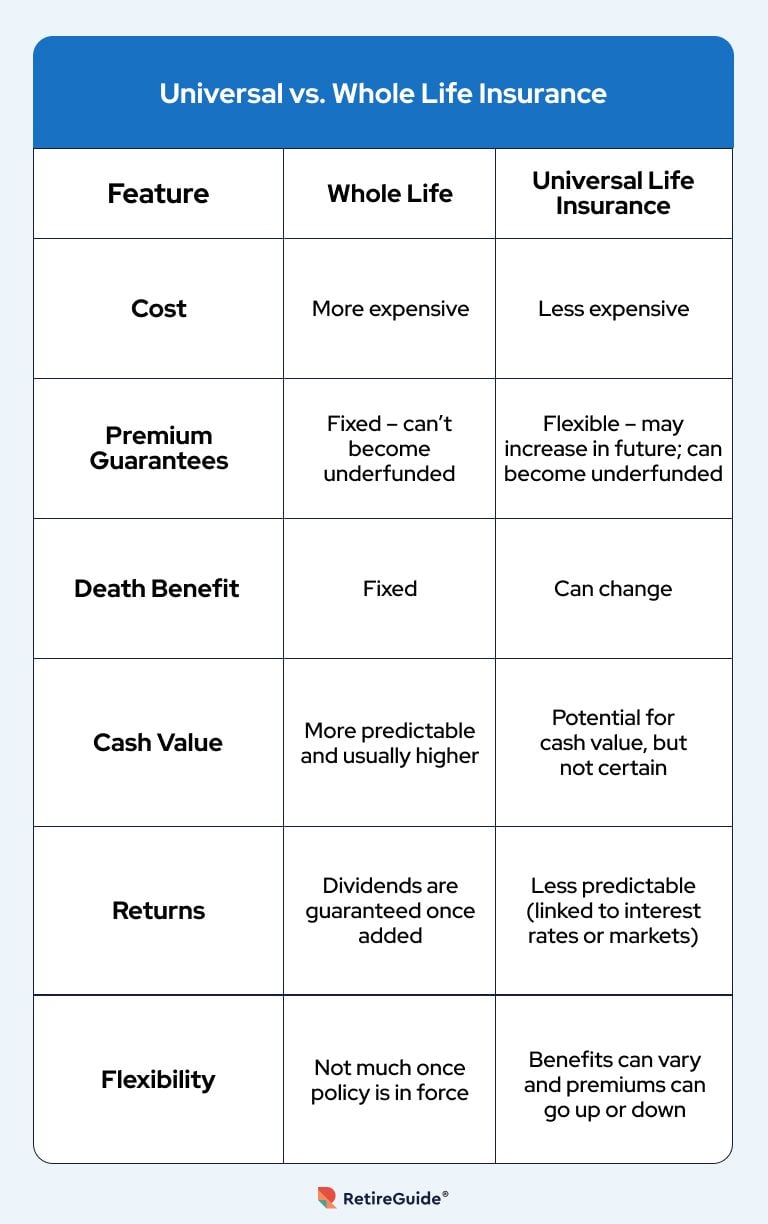

Unlike whole life insurance, universal life policies do not have fixed interest rates, making them less predictable. However, the flexibility in premium payments and the potential for tax-deferred growth make universal life insurance a popular choice for many individuals seeking long-term coverage with financial benefits. Additionally, policy loans and withdrawals can impact the cash value and may result in the policy lapsing without additional premium payments. Understanding the advantages and disadvantages of universal life insurance is essential for making informed decisions regarding long-term financial security.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Credit: www.investopedia.com

Introduction To Universal Life Insurance

|

Universal life insurance is a type of permanent life insurance that offers flexibility to policyholders in paying premiums, a cash savings component, and a death benefit. The policyholders can borrow against or cash in their savings portion, which grows tax-deferred over their lifetime. However, universal policies typically don't have fixed interest rates, so they are less predictable than whole life insurance policies. If the policyholder misses a payment on a universal life policy or doesn't contribute enough to the cash value, they may end up making several large payments to keep the coverage. Policy loans and withdrawals may deplete the cash value and could cause the policy to lapse without extra premium payments. |

Overall, universal life insurance can be a good option for those looking for flexibility in their life insurance policies. However, it is important to carefully consider the policy's features, benefits, and drawbacks before making a decision.

Financial Benefits

Universal life insurance provides financial benefits such as cash value accumulation and tax advantages. The cash value component grows tax-deferred over time, offering flexibility for policyholders to borrow against or cash in on the savings. However, universal policies may lack predictability due to fluctuating interest rates, potentially leading to additional premium payments to maintain coverage. Policy loans and withdrawals can deplete the cash value, risking policy lapse without supplemental premiums. While cashing out a policy is possible, surrender fees may apply, impacting the final payout. Understanding the pros and cons of universal life insurance is crucial for making informed financial decisions.

Premium Payment Options

Universal life insurance offers flexible premium structures that allow policyholders to adjust their premium payments. This means they can increase or decrease their premium amounts according to their financial situation. These changes in premium can have an impact on the policy’s cash value and death benefit, so it’s important for policyholders to understand the implications. Policyholders should carefully consider the potential impact of premium changes on the policy’s benefits and make adjustments accordingly to ensure their coverage meets their needs.

Credit: www.retireguide.com

Understanding Policy Loans And Withdrawals

Universal life insurance offers policyholders the flexibility to access cash savings through policy loans and withdrawals. This allows them to borrow against the cash value or cash in their savings component, which grows tax-deferred over time. It's a valuable feature that provides financial options within the policy.

| Universal life insurance is a type of permanent policy with flexibility in premium payments. |

| It includes a cash savings component and a death benefit for policyholders. |

| Policyholders can borrow against or cash in the savings portion, which grows tax-deferred. |

| However, policy loans and withdrawals can deplete cash value and lead to policy lapse. |

| Missing payments may require additional premiums to maintain coverage. |

Risks And Considerations

When considering Universal Life Insurance, be aware of potential risks. Policyholders should monitor premiums to avoid policy lapses. Understanding the cash value and flexibility is crucial for making informed decisions.

| Universal life insurance offers flexibility in premium payments and a cash savings component. Policyholders can access the cash value through loans or withdrawals, which grow tax-deferred. However, the interest rates are variable. If premiums are missed or cash value depleted, the policy may lapse without additional payments. Consider the risks carefully before opting for universal life insurance. |

Comparing Universal Life To Other Life Insurance Products

Universal life insurance is a form of permanent life insurance that offers flexibility in premium payments, along with a cash savings component and a death benefit. Policyholders have the option to borrow against or cash in their savings, which grows tax-deferred over their lifetime. Unlike whole life insurance, universal policies typically don't have fixed interest rates, making them less predictable. However, the flexibility in premium payments and the potential for cash value growth make it a popular choice for those seeking a long-term insurance solution.

When comparing universal life to term life insurance, individuals should consider their long-term financial goals and their need for a policy that offers both a death benefit and a savings component. While term life insurance provides pure protection for a specific period, universal life insurance offers a combination of protection and flexibility for the duration of the policyholder's life.

Real-life Applications

Universal life insurance is a form of permanent life insurance that offers flexibility in premium payments, a cash savings component, and a death benefit. Policyholders can borrow against or cash in their savings portion, which grows tax-deferred over their lifetime.

Disadvantages of universal life insurance include the lack of fixed interest rates, making it less predictable than whole life insurance. Additionally, missed payments or insufficient contributions to the cash value may result in the need for large payments to maintain coverage.

With a cash value life insurance policy, such as whole life or universal life insurance, policyholders can access the cash value. This can be done through methods such as cashing out or surrendering the policy, where the cash value minus any surrender fees is received.

How To Choose The Right Universal Life Policy

When choosing a universal life insurance policy, consider your long-term financial goals and risk tolerance. Assess the flexibility of premium payments and the potential for cash value growth. It's important to compare different policies and consult with a financial advisor to find the right fit for your needs.

Credit: www.ramseysolutions.com

Frequently Asked Questions

What Is A Universal Life Insurance Policy?

A universal life insurance policy is a form of permanent life insurance with flexible premiums and a cash savings component. It allows policyholders to access the cash value and provides a death benefit.

What Is The Disadvantage Of Universal Life Insurance?

The disadvantage of universal life insurance is its lack of fixed interest rates, making it less predictable. Missing payments can lead to additional large payments to maintain coverage.

What Is The Downfall Of Universal Life Insurance?

The downfall of universal life insurance is that policy loans and withdrawals can deplete your cash value, potentially causing the policy to lapse without extra payments.

Can You Cash Out A Universal Life Insurance Policy?

Yes, you can cash out a universal life insurance policy by accessing the cash value. However, if you choose to surrender the policy, you may incur surrender fees and receive less than the cash value. It's important to consider the impact on the death benefit and potential tax implications before making a decision.

Conclusion

Universal Life Insurance provides flexibility in premiums, a cash savings component, and a death benefit. Policyholders can access cash value, but missed payments may lead to coverage lapses. Consider the pros and cons carefully before deciding on a Universal Life Insurance policy.

What's Your Reaction?